Some books get you thinking and Fred Gratzon’s The lazy Way to Success definitely did that to me. Damn you, Fred!

I have seen the light. I now realize that my ingrained laziness has not only been one of the major forces shaping my life, it’s been a boost to almost every important area of my life.

Me, doing what I do best: Nothing.

Here are some random thoughts on how laziness has helped me in my university studies, in my work in IT, in leadership and in entrepreneurship.

The lazy student

When I started studying at the University of Southern Denmark (I graduated with a masters in computer science in 1994), I was always envious of the over-achievers. You know them – they’re the people who are always prepared for today’s lecture, have done their homework and never need to do any last-minute, aaaaargh-exams-are-only-two-weeks-away studying. Like I did. Every. single. semester.

I used to beat myself up for not being like them, but in the end I accepted, that I’m just not that person. The final realization came to me while I was writing my masters thesis (on virtual sensors for robots, if anyone wants to know), and I discovered that some days I can’t write. I literally can’t put two words together and have anything meaningful come out. I can frustrate myself nearly to death trying, but I won’t get anywhere.

And other days, writing is totally effortless and both the quantity and the quality of the output is high. I am in fact having one of those days today, I can’t seem to stop writing. What I realized was that this is me. It’s the way I work, and I have go with that.

So I adopted the lazy approach to writing, which is that I write whenever I feel like it. And my output on a writing day easily outweighs the x days where I didn’t get any writing done.

Incidentally, the thesis still got done on time and it got me an A. So there!

The lazy developer

Masters degree in hand I went on to become an IT consultant and developer, and I quickly learned this: If I’m programming something and it feels like work, I haven’t found the right solution yet. When the right solution presents itself, the task becomes fun and easy. I also get to admire the beauty of an efficient, simple solution.

Good code is a pleasure to maintain, tweak and refactor. Bad code is hard work. Also laziness means only doing things once, instead of repeating yourself all over the place – another hallmark of good code.

The lazy leader

After my IT days I went on to leadership and learned this: If leading people feels like hard work, you’re most definitely not doing it right. The lazy leader adapts his leadership style to the people around him to the point where it feels like he’s doing almost no work and people are leading themselves. I refer you to this classic Lao Tzu quote as proof that this notion is more than 2500 years old.

When I spoke at the Turkish Management Center’s HR conference in Turkey, one of the other speakers was Semco’s CEO Ricardo Semler. He said in his presentation that Semco recently celebrated the 10th. anniversary of Ricardo not deciding anything in the company. It started when he took 18 months out to travel the world, and discovered that the company ran just fine without him. If that ain’t laziness on a very high plane, I don’t know what is and you can read all about it in Ricardo’s excellent book The Seven-Day Weekend.

The lazy entrepreneur

As an entreprenur, my approach has been this: Start a lot of small projects and see which ones grab me. Rather than try to analyze my way to an answer to which opportunity is the best/will make me the most money/will be the most fun, I float a lot of ideas in a lot of places. Some happen, most don’t. The ones that happen are by definition the right ones, and they are always fun to work on. Always.

Conclusion

It’s common to think that success only comes with hard work, but I’ve found the opposite to be true for me. In my case, success has come from NOT working hard, and my laziness has definitely done me a lot of good. The only difficult part has been to let go of the traditional work ethic and accept my laziness. To work with it instead of against it.

Will the lazy approach work for you? Maybe not. Maybe you get more success from working long and hard, from putting your nose to the grindstone and applying yourself. But if you’ve never tried the lazy approach, how can you know that that doesn’t work even better? Give it a shot, you might like it!

If you enjoyed this post, you’ll probably also like these:

Allrighty then, I’m outta here.

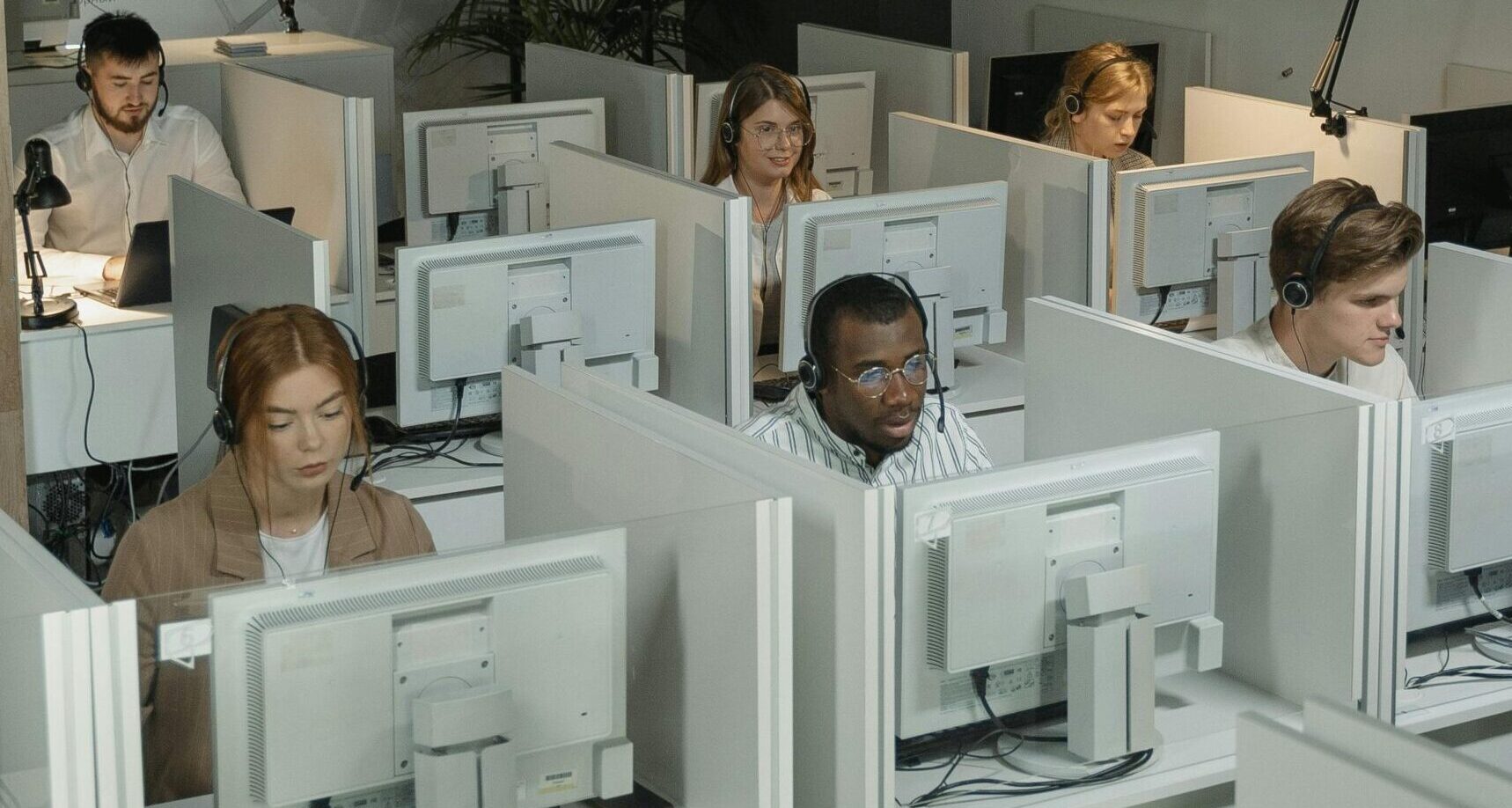

Allrighty then, I’m outta here. That’s right, the one and only Traci Fenton, one of the most determined, energetic, creative, fun, visionary people I have ever met, has agreed to blog right here.

That’s right, the one and only Traci Fenton, one of the most determined, energetic, creative, fun, visionary people I have ever met, has agreed to blog right here.

It pays to be happy. Studies show that businesses with happy employees consistently outperform their less happy competitors in the marketplace and in the stock market.

It pays to be happy. Studies show that businesses with happy employees consistently outperform their less happy competitors in the marketplace and in the stock market.

His reasoning: If he could attract the attention of world-class talent to the problem of finding more gold in Red Lake, just as Linux managed to attract world-class programmers to the cause of better software, he could tap into thousands of minds that he wouldn’t normally have access to. He could also speed up exploration and improve his odds of discovery.

His reasoning: If he could attract the attention of world-class talent to the problem of finding more gold in Red Lake, just as Linux managed to attract world-class programmers to the cause of better software, he could tap into thousands of minds that he wouldn’t normally have access to. He could also speed up exploration and improve his odds of discovery.